Budget Tips and Tricks to Survive the Holiday Season

Holidays are nearly approaching! While it is indeed the most wonderful time of the year, it is also the most expensive season of all. There are just too many things not to be missed or skipped on your budget list for holidays. For many of us, it has become a tradition to celebrate both Christmas and New Year in the grandest way possible. It is indeed a tradition that will be passed on and embraced by our future generation. While this celebration will remain the same for many succeeding years (or probably centuries), the yearly budget is constantly changing.

The recent economic turndown resulted in a worsening case of inflation. It means that the prices in the market are drastically increasing. Aside from the seemingly uncontrollable inflation, the supply and demand during the Holiday season are undeniably high, resulting to even more expensive rates for goods and services. For someone who is always on a tight budget like me, this will be a tough challenge. Handling my year-end budget is quite tricky yet manageable. All it takes is proper and timely planning to help you get through all these budget-shattering Holiday celebrations. You can also utilize the use of online calculators to help you out with your budget digitally. Listed below are some of the tips and tricks that you can do to survive this season.

Set a Budget and Stick to It

Set a Budget and Stick to It

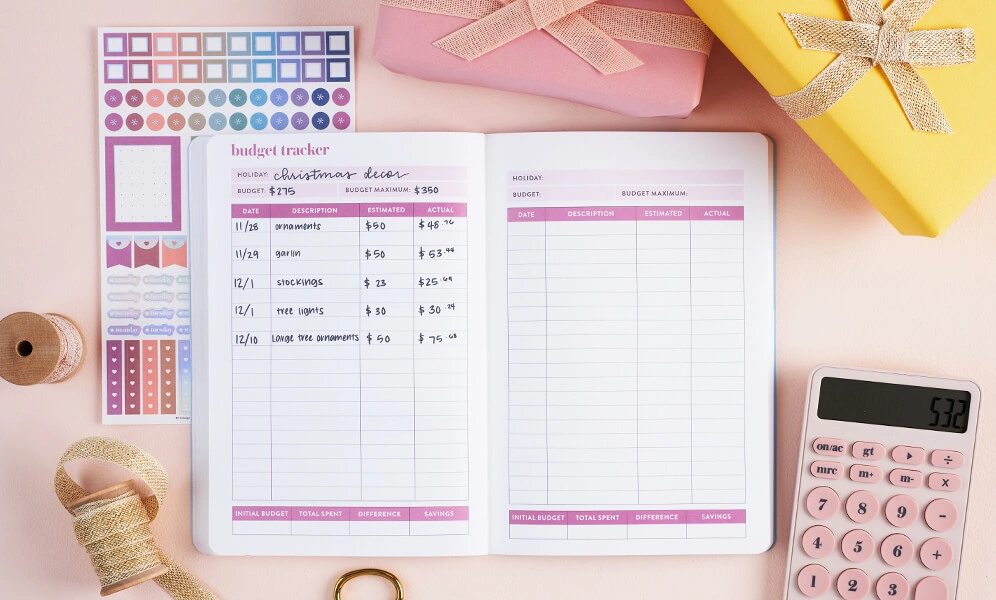

Holiday shopping can be very stressful, especially if things do not go as planned. Without setting a budget for holiday, there will be a great chance to overspend which will only ruin your savings for the next month or so. To prevent yourself from overspending, it is important to set a very strict budget for the holidays. You should know where exactly your money will go. To do so, list down all the goods and services that you need to purchase these coming holidays, check for their market prices, and canvass for the lowest rates to save more money.

With all the promos, sales, and limited offers for holidays, it is also easy to be tempted. You might consider buying these items even though they are not part of your holiday shopping list. Just because you were able to buy these items at discounted rates doesn’t mean you saved money from it. Setting a budget is not enough, you have to stick to it. Also, make sure to set rooms for price adjustments and lend extra savings for unexpected price changes.

Search for Better Deals and Discounts

A few of the best things about the Holiday season are the limited-time promos and sales offered by different brands. Most of these promos will last for a month or two and it is something you must take advantage of. Grab the opportunity to purchase the products during their promo period to save more money. Again, just make sure that these items are part of your allotted budget. There are many online and eCommerce platforms today that offer generous discounts and other exciting deals.

Some of these offer “free shipping” deals which is also a great way to save more money. These free shipping vouchers are more beneficial if you order the products in bulk. Some platforms also offer cash back which allows you to earn extra money for each item you buy from their shop. You can also do it the old way by collecting coupons and printed vouchers for additional discounts.

Take Advantage of your Credit Card Perks

When doing all your holiday spending, it is ideal to use your credit cards rather than paying them in cash or using your debit card. Whether you are planning a week-long travel or you want to spend money buying the perfect gift for your friends and loved ones, there are good reasons to use your cards as a form of payment. You can take advantage of the rewards that you can get from using your card for your holiday spending. The more you purchase, the more points you can earn. These points can be converted into various forms of rewards including cash back, freebies, and many other perks. You can also take advantage of some cards that allow items to be paid in 12 or 24-month installments with a 0% interest rate. To top it all off, using credit cards frequently and paying your bills on time will effectively increase your credit score. An excellent credit score allows you to apply for loans and be approved quickly.

Manage Your Budget with Online Calculators

To stay faithful to your budget and to prevent yourself from overspending, you can take advantage of those freely accessible online financial calculators. Using these online tools, you can manage all your credit card payments and ensure that your monthly credit card bills will be paid on time. If you are applying for a loan in preparation for the holidays, you can also use these financial calculators to help you estimate the potential monthly, bi-weekly, or weekly payments, and to determine whether or not it fits your budget.

There are also websites that offer a wide range of other financial calculation services. I recently came across calculator.me which provides a great number of online tools that allow you to easily calculate loan and credit card payments. It also offers calculators that are specifically programmed for auto loans and mortgages. There’s also a Savings calculator that helps you calculate the future value of a monthly investment as well as a Budget Planning Calculator to help you manage your monthly or holiday expenses.

Don’t Forget Your Regular Expenses

It is also important to remember that aside from your holiday expenses, you also have regular and monthly expenses to pay. These include your monthly electricity bills, internet service, phone and water consumption bills, and many other regular expenses that should not be overlooked. Not to mention the money that you need to lend for food and daily allowances. Unlike your holiday spending, these bills are more likely to be considered a top priority. It is important not to miss them, otherwise, you might find yourself in financial distress.

While we all want to celebrate holidays as extravagantly as possible, it is important to remember that we should not spend more than what we earn or what we can afford. Budget your money wisely and make sure to leave room for savings.