Fun Ways to Teach Kids About Financial Literacy

When I was a kid, my mom never failed to remind me of how I should spend my money wisely. As soon as I stepped into Grade school, she used to provide me money allowance on top of my daily packed lunch so I can still buy anything I want from the canteen. While she gave me the freedom to spend that money, she keeps on reminding me that I should only buy things I can afford and things that I only need. As I grew up, I started to realize how important it is to value your money and how you should manage all your expenses wisely so you’ll have enough savings for the future. My mom was right all along and I guess it is important for parents to educate their kids about financial literacy and how this information about proper money management can save them in many different circumstances.

Introducing them to financial literacy should not be complicated. Inputting too much information that they probably do not understand might overwhelm them. Listed below are some of the fun and entertaining ways to teach kids how to manage their finances at a very young age.

Engage Them in Money Conversation

There is no better place to introduce Financial Literacy to your kids other than your home. Parents are the kids’ first teachers, so if there is someone to teach them how to handle their finances, it would be you. If you are the type of parent who tends to overspend, chances are, children will adopt the same behavior. It is important to educate them on how to spend their money wisely, where exactly their money will go after spending it, and what things they can do with their savings. Little by little, you can introduce them to anything about money management through simple and fun conversations.

Kids’ attention span is limited but you can slowly input details and give them an idea about budgeting, saving, debt management, and many others. Engage them in small talk or conversation and willfully answer their queries.

Allow them to Shop with Minimal Supervision

Taking them with you as you shop for goods in a grocery shop or mall is a nice approach but allowing them to shop and budget their own money is a better idea. This approach reminds me of “Old Enough”, a hit Japanese reality Tv show (which is currently on Netflix by the way) where parents send their kids ages between 2 to 5 years old to perform errands. Here, they will give the toddlers some things to buy at a market or grocery without their supervision. The crew of the reality TV show will follow the kid as they perform the given tasks. Of course, in reality, we cannot just let our kids do the shopping alone.

You can simply provide them with a shop list and allow them to get their own basket and collect all the things indicated on their list. To add more challenge, give them a certain budget and let them pay for the goods at the cashier. This will not just teach them how to become independent but it will also teach them how to properly budget money and how to save by choosing items that are relatively cheaper.

Introduce Educational Games that will Teach them About Money

Almost all kids are now engaged in their mobile devices and it almost feels like it has become part of their basic necessity. You can also take advantage of this situation and introduce them to some educational games that they can play. I recently came across MortgageCalculator.org, a finance-centric site and I was surprised to see a great collection of browser-based “money” games. While the site is widely focused on providing free calculators for mortgages, loans, and more, they also have a special section that both kids and kids-at-heart will enjoy.

These online games are educational and surprisingly entertaining. This is an excellent approach to introducing financial literacy to kids, without them knowing that they are learning something new while having fun at the same time. I have tested some of their colorful games and these are my personal picks.

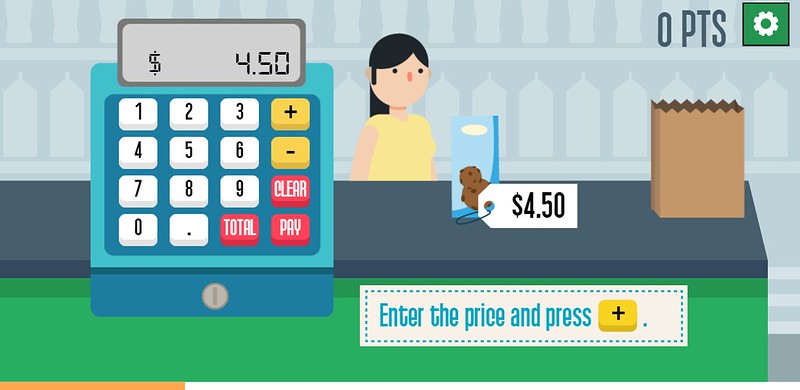

Grocery Cashier – As the title suggests, in this simulation game, you play the role of a cashier. The goal is to serve all the customers as quickly as possible. As soon as the customers hit the counter, you have to start manually adding the price value of each item to the cashier. You will then collect the payment which can be in the form of cash, vouchers, or cards.

Idle Money Tree – For kids who love playing idle or incremental games, Idle Money Tree is truly a perfect fit. As soon as the game starts, it prompts you to a virtual tree that apparently grows money bags. The goal is to collect as many coins as possible. Like most clicker games, you start the game by manually clicking the bags. As you earned enough coins, you can buy upgrades to collect money with minimal or no interaction at all.

Kingdom Wars – This game reimagines the classic Monopoly board game in ancient times. The goal is to become the most successful by driving all your computer-generated opponents into bankruptcy. You start with 500 in your savings and you must carefully and strategically spend this amount of money to outscore your opponents. You can buy properties and expand your territory in this game.

Coffee Shop – In this game, you will be tasked to run a coffee shop but unlike other restaurant management, the game requires you to manage everything based on your own discretion. For instance, you are the one to manage the revenue. You are responsible for buying the ingredients for your coffee, assigning prices for your product, and more. If you think you are clever enough to run the shop, this game is for you.

Be mindful that these are browser-based games. It means that you can access all these games by visiting their webpage. There is no need of installing the apps from the app store. They are also notably light and they won’t affect much of your phone storage.

Give them Allowance and Allow them to Budget

If they are already going to school, teach them how to budget their money for a week or two. Provide these kids with allowances that are good enough to last for two weeks. Leaving them money and allowing them to budget a certain amount alone, will certainly teach them how to spend their money wisely. Allow them to list down the things that they regularly buy in school and include those in their weekly or monthly budget.

Create Them a Bank Account and Introduce Savings

Opening a savings account for your child can provide a safe place for their money, and allow it to earn some interest. More importantly, this teaches them about banking and money management. Seeing their money grows will also encourage them to save more.

Money and finance management are very serious topics but you can still introduce this information to kids in fun and surprisingly entertaining ways.